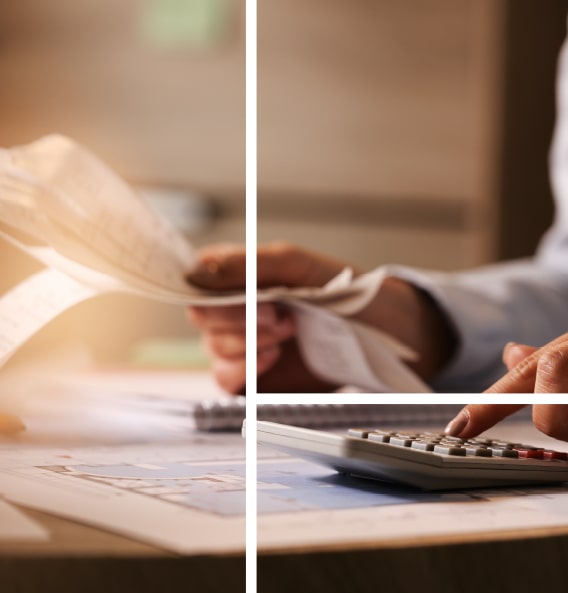

Corporate Income Tax

An entity that is entirely or partially foreign-owned and generates income from Qatari sources is taxed in Qatar. The tax obligation of a joint venture depends on how much of the earnings are distributed to the foreign partners. At the moment, no corporate income tax (CIT) is charged on corporate entities completely owned by Qatari nationals and GCC nationals residing in Qatar. Regardless of where it was incorporated, a company that has earned money with a Qatari source will be subject to tax in Qatar unless it is expressly exempt. With limited exclusions, taxable income is normally subject to a flat (CIT) rate of 10%.

BRINGING CLARITY FROM COMPLEXITY

Global Strategic Partners Union

Tax rates apply in the following instances:

- Before January 1, 2010, if a special arrangement with the Qatari government was signed, it is still in effect. If no rate is mentioned in the agreement, 35% is used.

- The rate for oil activities, as defined in Law No. 3 of 2007, cannot be less than 35%.

- WHTs (see the Withholding taxes section) apply to payments made to non-residents concerning specific service activities performed in Qatar that are unrelated to a PE.

Aside from the foregoing, fully owned subsidiaries of listed firms are now taxed to the extent of non-exempt ownership (i.e. foreign or non-exempt Qatari / GCC ownership). Previously, taxpayers believed that such subsidiaries were tax-exempt

Registration

All organizations conducting business in Qatar are obliged to register with the Qatar Tax Department (“QTD”) and subsequently get a tax card. The tax card is a need for several company procedures (including working with government agencies, receiving the entire invoice amount without withholding tax, etc.), so failing to register could have a considerable negative impact on firms. To maintain the smooth operation of your business, GSPU can assist you with getting and renewing your tax card.

Reporting and Compliance

Within four months following the end of the fiscal year, taxpayers are required to file tax returns and pay corporate income tax. Tax filing and payment obligations must be met since penalties might be severe. GSPU helps clients meet their tax filing duties.

Assessments & Non-objection Certificate: Obtaining tax assessments and NOC from the QTD is essential in Qatar for Share transfers, Branch de-registration, Company liquidation, Release of retention amounts, Tax certainty, etc. Our tax team has a wealth of expertise in getting tax assessments and NOCs from the QTD. Along with assisting you by establishing communication with the necessary authorities, we can also guide our good relationships at various levels at the QTD. Furthermore, GSPU can help you file objections and appeals before the Tax Appeal Committee if the QTD has imposed additional taxes and penalties as part of the assessment.

- Tax return preparation and filing

- Providing advice on annual tax payments

- Submitting a back tax return when a prior year’s tax return was late or not filed at all.

Make better decisions with us

The best choice for your successful business!

Bringing Clarity from Complexity

GSPU ADVISORY!

Simplifying complex structures reviewing the vital elements, and spotting effective tools for communication to assist clients make informed decisions and drive progress.

COMPATIBLE

CUSTOMISABLE

CONVENIENT