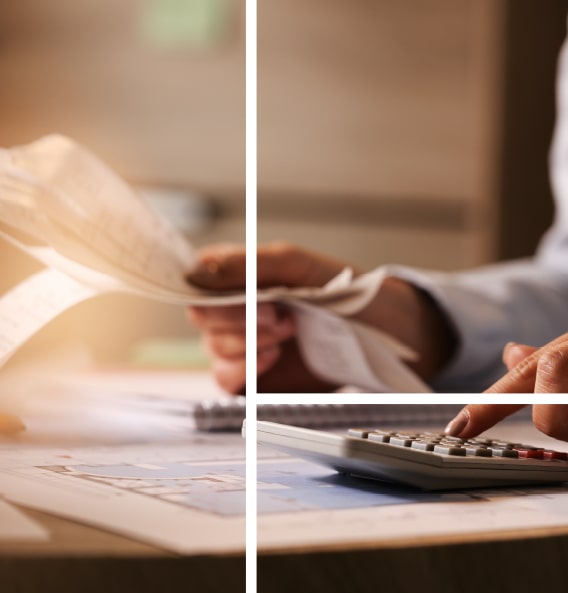

Excise Tax

Excise taxes are paid when excisable items become accessible for consumption. The general rule for the excise tax is that it is included in the selling price of the products, which means that all firms must alter their sales pricing to reflect the same. Every taxable person is required to file an excise tax return, but if your company is owned partially or entirely by a foreign national and is involved in activities such as importing, producing excisable goods, or running a tax warehouse, you must now file an excise tax return in addition to your annual corporate tax return. This return will include a summary of the excise tax owed to the GTA.

The GTA will handle excise tax proceedings in Qatar, and all taxable persons will be required to use the portals as well. Due to the complexity of managing the excise tax internally, enterprises will likely turn to service providers, such as ourselves, for assistance.

BRINGING CLARITY FROM COMPLEXITY

Global Strategic Partners Union

The State of Qatar levies an excise tax, which is a type of consumption tax, on certain products it regards to be hazardous to both human health and the environment. Revenues from the excise tax will be used to upgrade public services, such as hospitals, infrastructure, and education. A sustainable future shall be ensured by the Excise Tax, which enables The State of Qatar to fulfill its social policy objectives as part of the 2030 National Vision.

EXCISE TAX IMPLEMENTED IN QATAR

Excise tax is a one-time tax levied at the time of manufacture or importation of excisable products. Businesses that must pay excise tax are required to register, collect the tax, file regular returns, and pay the tax to the local authorities. Qatar implemented an excise tax on the following items at the following rates:

- Tobacco and its products – 100%

- Energy drinks – 100%

- Carbonated drinks – 50%

- Special purpose goods (consumed under specific conditions & authorizations) – 100%

As a consumption tax, Excise Tax is ultimately paid by final consumers, but it is collected earlier in the supply chain by taxable individuals (importers, producers, or tax warehouse keepers).When excise items are released for consumption, the excise tax is activated.

Businesses should thoroughly evaluate their excise tax responsibilities to guarantee full compliance and effective tax management. Businesses that must pay Excise Tax or intend to run a tax warehouse (if requested) must register for Excise Tax purposes, keep accounting books and records, file quarterly tax reports, and pay the tax due.

GSPU Qatar is pleased to help you assess the excise tax’s possible effects and create a road map outlining the activities that must be performed to get ready for the excise tax in Qatar.

We can assist you prepare for the Excise Tax transitional phase from a consultancy and compliance standpoint with a large team of specialists and experts:

- Count the taxable items

- If the goods cost more than QR 50,000, issue a certificate.

- Examine and file the tax return form

If you require any additional information or support regarding the Excise Tax Transition Period, please do not hesitate to contact us.

Make better decisions with us

The best choice for your successful business!

Bringing Clarity from Complexity

GSPU ADVISORY!

Simplifying complex structures reviewing the vital elements, and spotting effective tools for communication to assist clients make informed decisions and drive progress.

COMPATIBLE

CUSTOMISABLE

CONVENIENT