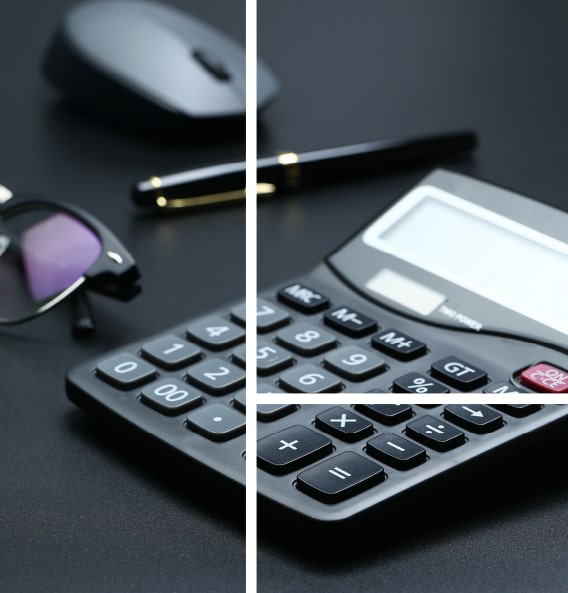

Accounting Services

Accounting services can be characterized as keeping records of monetary transactions which will be analyzed by the end of a specified period. Understanding the flow of funds in an organization, and setting up a financial plan will likewise help in determining the fate of the Business.

Here at GSPU, streamlining the accounting and administrative system of our clientsIs an important task. We provide the following services:

- Maintain accounting records and secure the database

- Prepare management reports

- Prepare and maintain sales & purchase ledger

- Reconcile bank statements

- Generate creditor listings and inventory reports

BRINGING CLARITY FROM COMPLEXITY

Global Strategic Partners Union

Being proficient in accounting, we understand the financial aspects of a business establishment. We guarantee our clients provide a reputation for their structure, maximizing their credibility, and standing out from their competitors. We adhere to the International Financial Reporting Standards (IFRS) and professionalism

Benifits of Acconting Services

- Decision Making

Accountancy and bookkeeping services assist with making safer, evidence-based choices and consider both the internal and external environment.

- Legal Requirement

As per the legal requirements of Qatar, appropriate accounting records are to be maintained, and the inability to do so will lead to legal concerns for the organization.

- Budget Preparation

A perfectly maintained book of records keeps a continuous track of the financial plan. It allows the financial plan to be more flexible and adapt to situations.

- Tracking Malpractice

Monetary inconsistencies can be easily tracked and amended.

- Averting Financial Crises

Since these recorded statements are recorded and assessed continuously, theyreduce the risk of a financial emergency.

- Sustainability

A clear & transparent book of accounting records assists a business to persist in the competitive market.

The fundamental goal of Accounting is to record, summarise and examine every financial transaction of the business. It helps both the management as well as the financers of the company. Some of the advantages of profiting from Accounting Services are:

- The company’s current financial standing can be understood from the analysis of the transaction records.

- The various records will help the company to keep track of its finances.

- The compliance situation of the Business can be identified from these company records.

The company must be able to rely on an expert who handles these financial details accurately.

Accounting and bookkeeping are related but have slight differences:

The process of Accounting includes Recording, Summarizing and analyzing the company’s total financial transactions, whereas the act of bookkeeping includes recording the company’s total financial transactions. The Bookkeeping process does not involve any analysis.

- The process of Accounting analyzes the company’s total financial transactions and for taking decisions about the future of the Business, whereas bookkeeping is associated only with the recording of the company’s total financial transactions.

- The process of Accounting includes Bookkeeping, but Bookkeeping is a step in the complete procedure and forms the basis for accounting which helps the Accountant & the management in decision-making.

IFRS stands for International Financial Reporting Standards. To bring transparency and to create common rules & regulations in the world of business affairs across boundaries rules have been formulated.

- Are the IFRS applicable to SMEs?

Yes, IFRS apply to SMEs

- According to the applicable laws, what are the records to be kept?

Each organization is expected to keep accounting records showing its financial transactions whenever the organization’s financial position must be precisely uncovered and empowering the partners or shareholders to affirm that the company records are appropriately kept as per the arrangements of the Commercial Companies Law or any other applicable Laws. Such records include, yet are not restricted to, bank statements, sales and purchase invoices, payment and receipt vouchers, LPOs, contracts/arrangements, and so on.

- Accounting records are to be kept for what period?

Each organization is expected to save its accounting books in its head office centre for at least 10 years from the end of the financial year of the organization.

- Are electronic copies accepted?

An electronic copy of the original documents & records kept can be maintained by the company.

The financial state of a business can be improved based on the services provided by an accountant. The records of business transactions will enhance the organisation’s goodwill and build trust among financial backers.

Some important factors to be considered before evaluating an accounting firm

- An accounting firm’s fees must be within the scope of the organisation. Depending on the charges levied by the accounting firm, the Business should finalize whether the services given by the firm are necessary.

- The management must be aware of the number of services a firm provides. Some firms will also offer other types of accounting services. These firms process data faster as they have experience in the field.

- The firm certifications must be reviewed by the client business. This will allow the client firm to decide if their packages are reasonable.

It is often a misconception that accounting management is a redundant & repetitive activity that utilizes a large portion of a small business’s resources.

- The accounting system can give all the fundamental insights about the business which will, in turn, help the management in figuring out the current state of the Business and plan for the future.

- The bookkeeping system will likewise assist the administration in understanding the company’s tax structure and filing taxes.

- Keeping records of business transactions is standard practice and ought to be followed by every organization.

SCALE NEW HEIGHTS OF SUCCESS WITH US

Expert business partner to ensure business success!!!

A reliable partner with a team of experts delivering advice on business challenges to ensure long-term success and credibility in 500+ Global Conglomerates across diversified sectors.

Bringing Clarity from Complexity

GSPU ADVISORY!

Simplifying complex structures reviewing the vital elements, and spotting effective tools for communication to assist clients make informed decisions and drive progress.

COMPATIBLE

CUSTOMISABLE

CONVENIENT