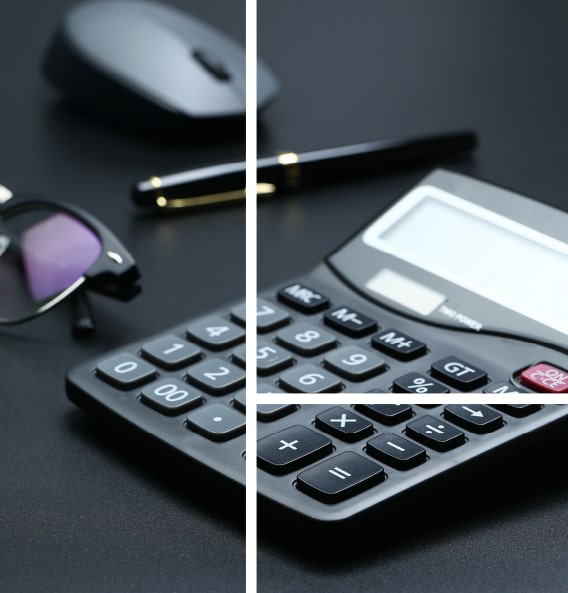

Backlog Accounting

At the point when a business is set up, a wide range of organizations can focus to provide the products or services so the business enhances higher than ever. During this, the organizations purposely or unexpectedly don’t record the monetary transactions of the business. This can create some issues for the business over the long haul and this is why Updating Backlog Accounts is significant for a business.

A backlog is a buildup of unfinished work. Various organizations may not have the ability to attend to these backlogs. When updating backlogs, we ensure the recording of unfulfilled transactions to correctly determine the financial position of the company.

BRINGING CLARITY FROM COMPLEXITY

Global Strategic Partners Union

services for a global network of creators

We gives you unmatched agility without compromising on experience

1

Branding & identity

It has survived not only five centu ipsum duos.

Data engineering

It has survived not only five centu ipsum duos.

2

Project planning

It has survived not only five centu ipsum duos.

3

HR support

It has survived not only five centu ipsum duos.

4

- Cash Flow management will be improved

Updating the backlog accounts provides insights into the organization’s past from which the management can accurately deal with the organization’s assets.

- Audit Process will be made easier

The audit process would be simplified for the auditor as past transactions have been made available. It would likewise permit them to compare the past information produced by the organization and infer trends.

- Save time

If the past organization’s financial records are absent, the management won’t need to invest its valuable time in producing the records for the past term so that they can compare them with the ongoing reports. This would defer of all the company’s significant developmental cycles.

- Simplify the Real-Time Decision making

After the comparison of the past & the ongoing information, the management can recognize loopholes in the organization.

- Future Planning

After an analysis of past data, the upper level of management can decide on the appropriate organizational strategy.

- Ease of data collection

At the point when the accounts are updated, it would be simple for the organization’s management to figure out the past information if they might want to graph a trend line or start research concerningwhat are the preferences of the clients.

- Data Duplication will be avoided

Duplicate data entire can be assessed, removed, and update the current data to rectify these errors.

- Clear and Transparent Status of the accessible assets

With the information on all the quarters, the organization would be better prepared to comprehend its financial position and which division requires more care.

Reports are to be created to measure a company’s performance. Reports are to be produced likewise to anticipate the business future. These reports are compulsory documents for any business association. Probably the important records and reports that should be updated are:

- Financial position will be reflected in the balance sheet

- Profit and loss account

- Cash flow statements

- Receivables and payables list

- Report on sales performance

- Report on expenses

- Financial ratio analysis

- Working capital analysis

- Break-even analysis

Legitimate following of the company records helps in securing goodwill. It is advisable to maintain the records correctly from the initial date. We at GSPU deliver a wide assortment of accounting services and assist in backlog accounting. Contact us for further assistance.

SCALE NEW HEIGHTS OF SUCCESS WITH US

Expert business partner to ensure business success!!!

A reliable partner with a team of experts delivering advice on business challenges to ensure long-term success and credibility in 500+ Global Conglomerates across diversified sectors.

Bringing Clarity from Complexity

GSPU ADVISORY!

Simplifying complex structures reviewing the vital elements, and spotting effective tools for communication to assist clients make informed decisions and drive progress.

COMPATIBLE

CUSTOMISABLE

CONVENIENT