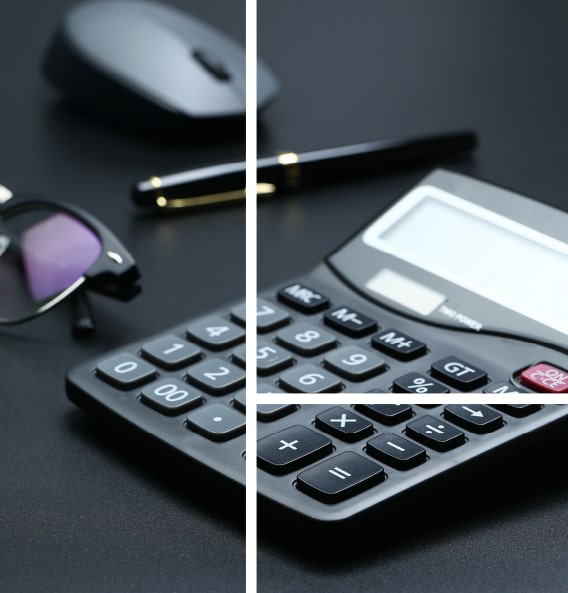

Forensic Accounting Services

Companies have a greater likelihood of getting involved in legal conflicts when business ecosystems get more complicated. Forensic accounting services can help in preventing unlawful business practices.

Mainly Forensic accounting procedures are of 2 types:

- Litigation Support Services

Here, the accountant will determine the overall losses suffered by each party and, in accordance, assist with an out-of-court settlement. The accountant can testify as an expert witness if the disagreement ends up in court.

- Investigative or Fact-Finding Services

The accountant will investigate the operations of the organization and find any instances of fraud or embezzlement.

BRINGING CLARITY FROM COMPLEXITY

Global Strategic Partners Union

services for a global network of creators

We gives you unmatched agility without compromising on experience

1

Branding & identity

It has survived not only five centu ipsum duos.

Data engineering

It has survived not only five centu ipsum duos.

2

Project planning

It has survived not only five centu ipsum duos.

3

HR support

It has survived not only five centu ipsum duos.

4

Benefits of Forensic Accounting

- Reducing Losses

Forensic accounting lowers the probability of losses.

- Increases Effectiveness

Lowers critical errors which eventually affect employees’ productivity. The accountant recognizes flaws or causes of inefficiency which leads to reform.

- Reducing the risk of exploitation

You may deal with fraud and mismanagement of funds by using forensic accounting, which will identify the risks of exploitation beforehand.

- Avoid legal issues

The number of legal challenges tends to rise more quickly as the business expands. You can examine the legal concerns more closely by utilising forensic accounting. Additionally, this aids in streamlining company procedures and activities.

- Interpreting Contractual Conflicts

Forensic accounting will assist in resolving contractual conflicts and attract additional clients.

- Supports Criminal Investigations and Defense

An organisation can identify flaws in the way its operations are carried out with the help of forensic accounting.

- Supports formulate Economic Policies

An organization can find out the imperfections in their business operations and carry out financial policies with a stronger framework.

- Improves Brand Reputation

Forensic accounting can protect the goodwill of a company as it prevents mismanagement of funds.

- Enhances the Investment Decisions

Forensic accounting permits us to compare the accounting data of the previous and present time. This permits us to go with needed changes in our decision concerning the allocation of the organization’s assets.

- Streamlines Litigation and Business Valuation

Forensic accounting aids in the investigation of a specific firm concerning the pricing and profitability of the company as well as the presentation of the company’s net worth in cases of business valuation and litigation.

GSPU Forensic Accounting Services

To provide a high cash-flow framework system at GSPU we aim to develop the most efficient and effective financial structure. Our wide range of services includes:

- Financial data analysis

- Evidence Analysis

- Compiling information

- Tracing illicit funds

- Damage Assessment

- Due Diligence Reviews

- Business Valuation

- Report Generation

The procedure through which a review of the business’s accounts is carried out is referred to as forensic accounting. Following this assessment, the results are subsequently submitted in court. The study of the business involves a variety of tasks, including financial or company accounting, Company auditing, and other investigative techniques.

Accountants all over the world should employ a variety of investigative strategies to learn essential details about a company. These are a few of these methods:

Background checks are one of the simplest yet most efficient investigative methods. The accountant will be informed about a corporation by reading historical transactions and agreements made.

Another easy yet efficient way to comprehend the nature of the Business is to gather information from reliable sources. It is important to keep in mind that only information obtained from reputable and reliable sources should be used since there is a guarantee that the information from these sources will be accurate.

SCALE NEW HEIGHTS OF SUCCESS WITH US

Expert business partner to ensure business success!!!

A reliable partner with a team of experts delivering advice on business challenges to ensure long-term success and credibility in 500+ Global Conglomerates across diversified sectors.

Bringing Clarity from Complexity

GSPU ADVISORY!

Simplifying complex structures reviewing the vital elements, and spotting effective tools for communication to assist clients make informed decisions and drive progress.

COMPATIBLE

CUSTOMISABLE

CONVENIENT