Transfer Pricing

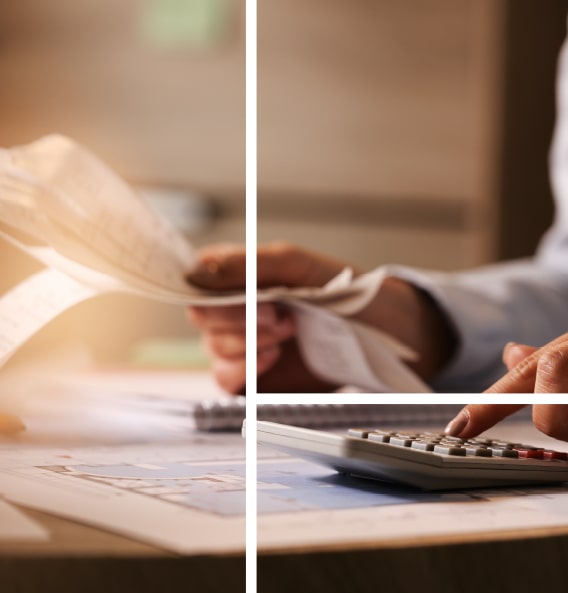

Tax and transfer pricing concerns can take several forms and degrees of seriousness, such as transferring earnings to low-tax jurisdictions, tax evasion, and tax fraud. Your capacity to comprehend taxpayer activities and financial conditions can be improved by working with a reliable, international third-party data source to help reduce these dangers.

Even the most knowledgeable data and tax specialists may find it challenging to manage the complexities of tax and transfer pricing. When people and/or companies fail to provide comprehensive, current, or accurate information to support a tax assessment, transfer pricing determination, or customs policies, problems may occur.

BRINGING CLARITY FROM COMPLEXITY

Global Strategic Partners Union

The Qatari tax authority has confirmed that every taxpayer is required to keep reasonable transfer pricing documentation on-site in Qatar that reflects the functional and economic analysis and the determination of arm’s length pricing. This requirement extends beyond the need to submit a transfer pricing declaration and also applies to taxpayers who are not otherwise required to submit a Master file and Local file on the Dhareeba portal.

Enhance your existing database with detailed information on business structures, beneficial owners, intangible property profiles, M&A transactions, penalties and enforcement data, and transfer pricing valuations. You can feel more confident if you have access to these data solutions whether creating, collecting, or evaluating tax and transfer pricing documentation or conducting investigations.

When auditing and/or assessing a corporation for corporate tax, the tax authorities may at any moment ask for the supporting paperwork. To conduct an audit of a company’s transfer pricing, the following data and documentation are needed:

- Information and records about the entity’s activities and functions

- Information and documentation on the activities, roles, and financial outcomes of its related entities, as well as with whom transactions are concluded

- Data on potential comparisons, including internal comparisons of linked entities

- Information on the activities, financial performance, and interactions between possibly comparable entities.

- Information and other documents owned by the entity or connected entities

- Prepare now

- On the next 30th April – TP Disclosure Form and income tax return must be submitted

- On the next 30 June – TP Local File and Master File should be submitted to GTA.

- On the next 31 December – Submit the TP CbC to GTA

- TP Memorandum

- TP Risk Assessment

- TP Policy Update

- TP Documentation Assistance

- Benchmarking study

- Implementation of Updated Policy

Make better decisions with us

The best choice for your successful business!

Bringing Clarity from Complexity

GSPU ADVISORY!

Simplifying complex structures reviewing the vital elements, and spotting effective tools for communication to assist clients make informed decisions and drive progress.

COMPATIBLE

CUSTOMISABLE

CONVENIENT