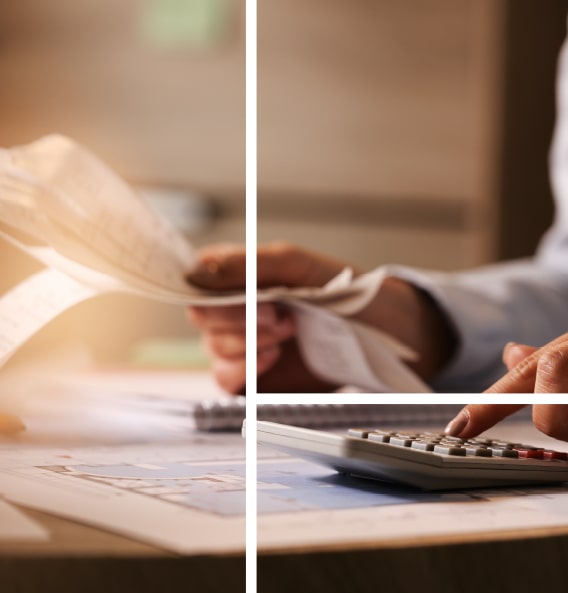

Contract Reporting

A process for gathering, evaluating, and disseminating significant contract-related insights is referred to as contract reporting. The number of contracts a business manages, the resources at service, and the metrics a business uses to track progress will all impact the contract reporting process.

Contracts that taxpayers sign with residents and non-residents must be reported to the GTA within 30 days of the contract’s signature (subject to certain financial specifications). If the contract is not disclosed in accordance with the legal requirements, the New Tax Law and Regulations impose a penalty of 10,000 Qatari riyals (QAR).

BRINGING CLARITY FROM COMPLEXITY

Global Strategic Partners Union

Contract notes must be submitted if the following conditions are met:

- Contracts with residents or non-residents with a permanent establishment in the state with a value of at least (200,000) two hundred thousand Riyals for service contracts and (500,000) five hundred thousand Riyals for contracting, supply, and service contracts.

- Non-resident contracts have no permanent establishment in the state, regardless of value.

The significance of contract reporting resides in its ability to maintain control over the business contracts and the data it includes, even in the face of continually increasing numbers. The quantity of contracts a business considers, drafts, oversees and keeps increases as a business grows. With a small team, this makes it hard to maintain track of all of the contract portfolios.

- Failure to meet contract deadlines: Lack of visibility into upcoming contract milestones and deadlines can make it difficult to oversee and manage relationships with vendors and consumers. It may even lead to undesired contract renewals in some situations.

- Controversy across departments: Communicating contractual obligations and expectations across departments becomes more difficult as it comes to managing more contracts. Last-minute demands and unfilled promises can lead to tension.

- Tough to assess performance: It might be difficult to measure success against legal KPIs unless one has a firm grasp of contract compliance and other contract measures.

- Taking risk management too late: Contract reporting provides more information than just contract length and agreed-upon terms. It can also inform the status of customer relationships and alert potential contractual risks.

- Contractual violation: Accurately tracking contracts will help to avoid the pitfall of missing deadlines. Furthermore, there may be severe consequences, especially if a contract is violated.

- Inform stakeholders concerning contracts.

- Recognise and act promptly on contractual hazards.

- Reduce legal complexity and focus on key data points.

- Effectively manage contract deadlines.

Make better decisions with us

The best choice for your successful business!

Bringing Clarity from Complexity

GSPU ADVISORY!

Simplifying complex structures reviewing the vital elements, and spotting effective tools for communication to assist clients make informed decisions and drive progress.

COMPATIBLE

CUSTOMISABLE

CONVENIENT